38+ mortgage interest deduction phase out

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. If you take the.

Mortgage Interest Deduction Bankrate

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

. Get Instantly Matched With Your Ideal Mortgage Lender. Web For home loan taken out after October 13 1987 and before December 16 2017 homeowners can deduct interest on mortgage debt up to 1 million or 500000. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web In 2009 your deduction for certain types of itemized deductions including mortgage interest begins to phase out at an adjusted gross income of 166800. However higher limitations 1 million 500000 if married. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web To be perfectly clear the mortgage interest deduction can only be used by a homeowner if they choose to itemize deductions on their return. Web Keep your total interest amount in mind and compare it to the standard deduction for your taxpayer filing status. If you gross more than 166000 your mortgage interest deduction begins to get phased out Every 100 you earn over.

They also both get an additional standard deduction amount of. It was estimated by Congress Joint Committee on Taxation report JCX-3-17. Web Most homeowners can deduct all of their mortgage interest.

Web Mortgage Interest Deduction Phase Out. Web Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. For example the standard deduction amounts. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

For tax year 2022 those amounts are rising to. Web Every April 15 about 34 million Americans claim the mortgage interest tax deduction. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web For 2022 theyll get the regular standard deduction of 25900 for a married couple filing jointly. Ad 10 Best Home Loan Lenders Compared Reviewed.

Comparisons Trusted by 55000000. Lock Your Rate Today. Ad Shortening your term could save you money over the life of your loan.

Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on.

The Home Mortgage Interest Deduction Lendingtree

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mark Hanson Mrmarkhanson Twitter

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

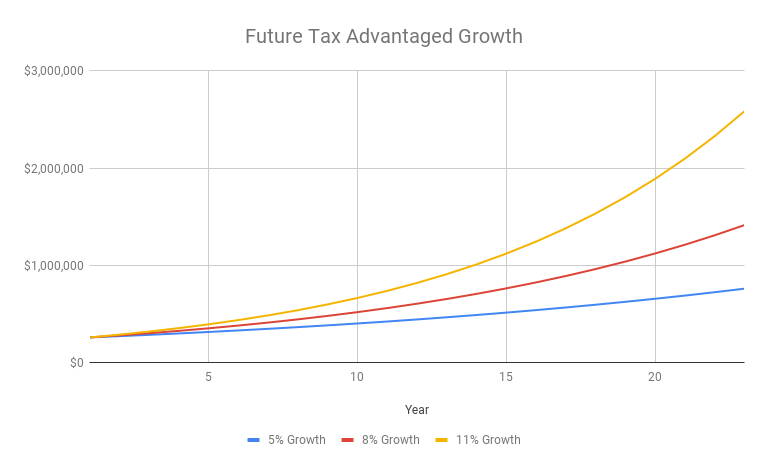

Why You Should Max Out Your 401 K In Your 30s

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Phaseout

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction How It Works In 2022 Wsj

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Maximum Mortgage Tax Deduction Benefit Depends On Income

Gutting The Mortgage Interest Deduction Tax Policy Center

Mathematical Methods For Physics And Engineering Matematica Net

Clat 2024 Notification Out Application Form Eligibility Syllabus Preparation Tips

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service